1 – FUTURE VALUE (FV) : FINANCIAL FUNCTION IN EXCEL

If you want to find out the future value of a particular investment which has a constant interest rate and periodic payment, use the following formula –

FV (Rate, Nper, [Pmt], PV, [Type])

- Rate = It is the interest rate/period

- Nper = Number of periods

- [Pmt] = Payment/period

- PV = Present Value

- [Type] = When the payment is made (if nothing is mentioned, it’s assumed that the payment has been made at the end of the period)

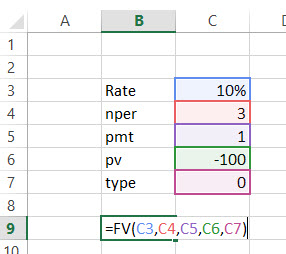

FV EXAMPLE

A has invested US $100 in 2016. The payment has been made yearly. The interest rate is 10% p.a. What would be the FV in 2019?

Solution: In excel, we will put the equation as follows –

= FV (10%, 3, 1, – 100)

= US $129.79

2 – FVSCHEDULE : FINANCIAL FUNCTION IN EXCEL

This financial function is important when you need to calculate the future value with the variable interest rate. Have a look at the function below –

FVSCHEDULE = (Principal, Schedule)

- Principal = Principal is the present value of a particular investment

- Schedule = A series of interest rate put together (in case of excel, we will use different boxes and select the range)

FVSCHEDULE EXAMPLE:

M has invested US $100 at the end of 2016. It is expected that the interest rate will change every year. In 2017, 2018 & 2019, the interest rates would be 4%, 6% & 5% respectively. What would be the FV in 2019?

Solution: In excel, we will do the following –

= FVSCHEDULE (C1, C2:C4)

= US $115.752

3 – PRESENT VALUE (PV) : FINANCIAL FUNCTION IN EXCEL

If you know how to calculate FV, it’s easier for you to find out PV. Here’s how –

PV = (Rate, Nper, [Pmt], FV, [Type])

- Rate = It is the interest rate/period

- Nper = Number of periods

- [Pmt] = Payment/period

- FV = Future Value

- [Type] = When the payment is made (if nothing is mentioned, it’s assumed that the payment has been made at the end of the period)

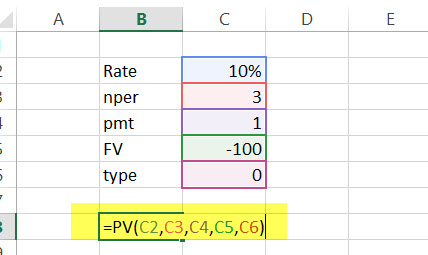

PV EXAMPLE:

The future value of an investment is US $100 in 2019. The payment has been made yearly. The interest rate is 10% p.a. What would be the PV as of now?

Solution: In excel, we will put the equation as follows –

= PV (10%, 3, 1, – 100)

= US $72.64

4 – NET PRESENT VALUE (NPV) : FINANCIAL FUNCTION IN EXCEL

Net Present Value is the sum total of positive and negative cash flows over the years. Here’s how we will represent it in excel –

NPV = (Rate, Value 1, [Value 2], [Value 3]…)

- Rate = Discount rate for a period

- Value 1, [Value 2], [Value 3]… = Positive or negative cash flows

- Here, negative values would be considered as payments and positive values would be treated as inflows.

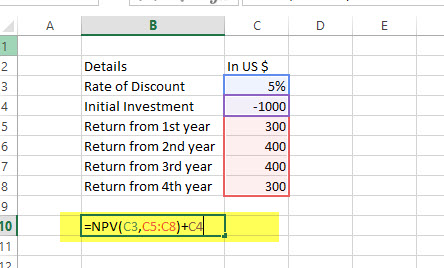

NPV EXAMPLE

Here is a series of data from which we need to find NPV –

| Details | In US $ |

| Rate of Discount | 5% |

| Initial Investment | -1000 |

| Return from 1st year | 300 |

| Return from 2nd year | 400 |

| Return from 3rd year | 400 |

| Return from 4th year | 300 |

Find out the NPV.

Solution: In Excel, we will do the following –

=NPV (5%, B4:B7) + B3

= US $240.87

5 – XNPV : FINANCIAL FUNCTION IN EXCEL

This financial function is similar as the NPV with a twist. Here the payment and income are not periodic. Rather specific dates are mentioned for each payment and income. Here’s how we will calculate it –

XNPV = (Rate, Values, Dates)

- Rate = Discount rate for a period

- Values = Positive or negative cash flows (an array of values)

- Dates = Specific dates (an array of dates)

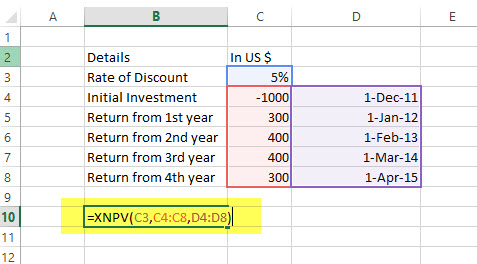

XNPV EXAMPLE

Here is a series of data from which we need to find NPV –

| Details | In US $ | Dates |

| Rate of Discount | 5% | |

| Initial Investment | -1000 | 1st December, 2011 |

| Return from 1st year | 300 | 1st January, 2012 |

| Return from 2nd year | 400 | 1st February, 2013 |

| Return from 3rd year | 400 | 1st March, 2014 |

| Return from 4th year | 300 | 1st April, 2015 |

Solution: In excel, we will do as following –

=XNPV (5%, B2:B6, C2:C6)

= US$289.90

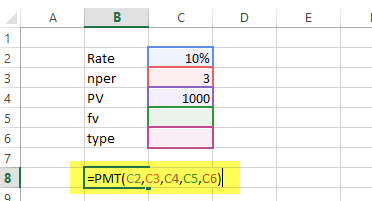

6 – PMT : FINANCIAL FUNCTION IN EXCEL

In excel, PMT denotes the periodical payment required to pay off for a particular period of time with a constant interest rate. Let’s have a look at how to calculate it in excel –

PMT = (Rate, Nper, PV, [FV], [Type])

- Rate = It is the interest rate/period

- Nper = Number of periods

- PV = Present Value

- [FV] = An optional argument which is about the future value of a loan (if nothing is mentioned, FV is considered as “0”)

- [Type] = When the payment is made (if nothing is mentioned, it’s assumed that the payment has been made at the end of the period)

PMT EXAMPLE

US $1000 need to be paid in full in 3 years. Interest rate is 10% p.a. and the payment needs to be done yearly. Find out the PMT.

Solution: In excel, we will compute it in the following manner –

= PMT (10%, 3, 1000)

= – 402.11

2nd year,

=PPMT (10%, 2, 3, 1000)

= US $-332.33

0 Comments

कमेंट केवल पोस्ट से रिलेटेड करें